Taxation

Ivana Nitzan, Aviv Marshell and Anita Berdisheiv

About the project

T

A

I

B

T

T

Our project addresses the issue of taxation models.

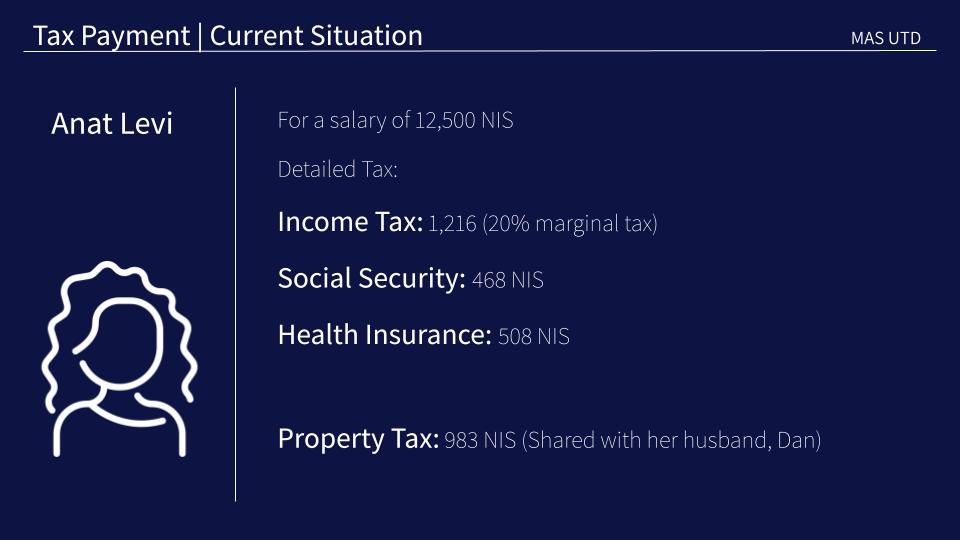

Taxes are payments collected through coercion from residents and citizens by the national authorities in order to finance governmental activities. Taxes are aimed to create social equality by redistributing funds and directing activity through tax incentives.

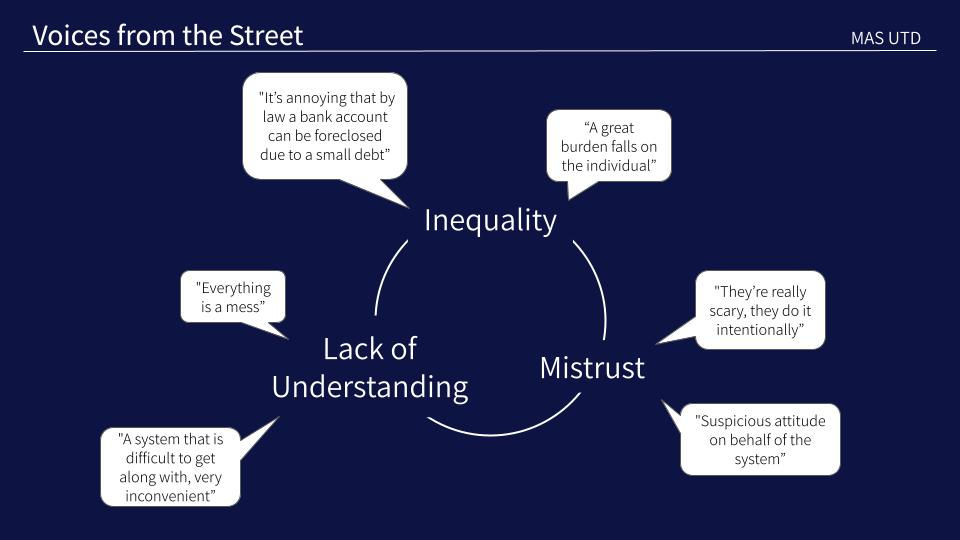

After conducting a number of interviews with randomly selected individuals on the street regarding the taxation system in Israel, we concluded that while the general population does understand the need for taxation, they do not understand how the taxation system operates, finding it to be unequal and therefore distrustful.

In order to address this problem, we decided to integrate all direct taxation into a single entity, proposing an efficient and accessible system that would enable individuals to customize personal tax levels based on predetermined criteria. Such criteria might include age, marital status, education, employment, financial situation, health, and ecological footprint.

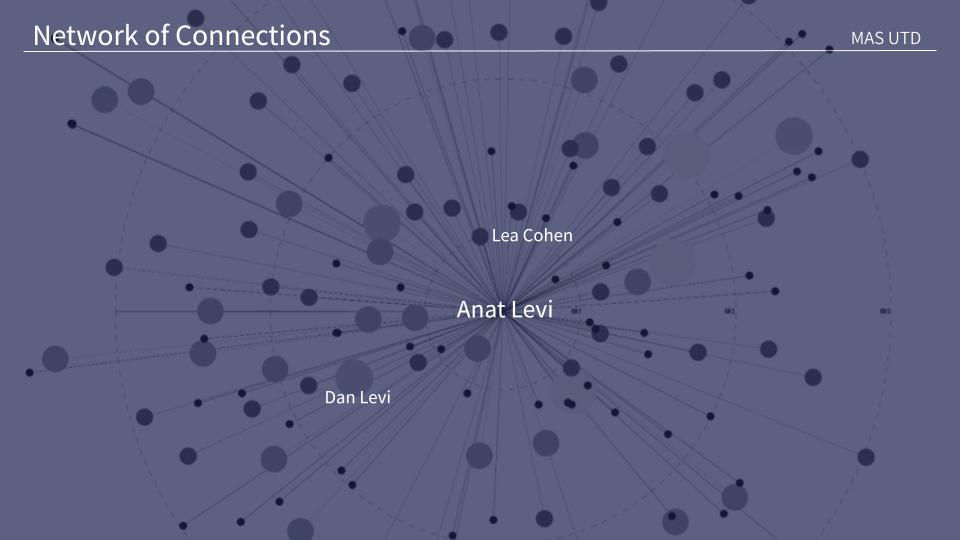

By implementing a network of individual connections, this dynamic system reacts to changes and emergencies in real-time. In the case of an individual not being able to pay their taxes, the debt can be converted to an equally-valuable form of contribution.

The system is secure and completely transparent, allowing for each individual to easily their tax calculation method and how these funds are invested. The system also allows individuals to make decisions as to the channel of investment as it regards their taxes.

This logical and accessible framework corresponds to the essential need of personal consideration and is implementable both on a personal and a business level.